As a Kraken user, you should be aware of your tax reporting obligations when it comes to your cryptocurrency investments. Kraken, a leading cryptocurrency exchange, offers a variety of trading features and services, making it essential for investors to be well-informed about the tax implications of their activities.

Tax reporting for Kraken may involve different aspects, such as reward earnings from staking or referral programs, interest earned on your investments, and the cost basis for your cryptocurrency transactions. Additionally, you are required to report your profits or losses from trading, whether you’re using margin or not. To stay in compliance with U.S. tax regulations, it’s vital that you understand and adhere to the correct reporting practices for your cryptocurrency investments.

In order to streamline your Kraken tax reporting experience, several tools and guides are available to help you navigate the process. Familiarizing yourself with the requirements and utilizing these resources makes tax reporting much easier, ensuring that your cryptocurrency activities on Kraken are fully compliant with the relevant tax laws.

Trading on Kraken

When trading cryptocurrencies on Kraken, you’re utilizing a well-established exchange that offers a wide range of trading options. Kraken supports various cryptocurrencies, allowing users to trade numerous digital assets. To begin trading on Kraken, you’ll first need to create an account, complete the necessary verification steps, deposit your funds, and explore the trading platform.

As you start trading, it’s essential to be aware of the tax implications associated with your cryptocurrency transactions. Kraken itself does not provide dedicated tax reporting tools or documents such as 1099 forms, but users are responsible for determining and remitting any applicable taxes to the appropriate authorities.

To remain tax-compliant, you should maintain a record of your trades and transaction history on Kraken. You can export your transaction data in CSV format to help keep track of your trading activities. This data will serve as your primary source for calculating gains or losses incurred during trading and report them accurately on your tax returns.

Additionally, remember to consider any taxable events that might occur while trading on Kraken. These include, but are not limited to, selling one cryptocurrency for another, exchanging crypto for fiat currency, and participating in margin trading. If you’re uncertain about specific tax liabilities or reporting requirements, it’s advisable to consult with a tax professional.

In conclusion, having a transparent and comprehensive understanding of your trading activities on Kraken will help you manage your tax obligations effectively. Exporting your transaction history in CSV format, thoroughly analyzing your trading data, and staying informed about potential tax liabilities will ensure that you can maintain a compliant and successful trading experience.

Income From Staking and Gains

When it comes to income from staking and capital gains on Kraken, it is essential to maintain accurate records. Staking rewards on Kraken are generally taxable, so it’s crucial to report these rewards to ensure compliance with tax laws.

In order to calculate your gains, losses, and income from staking and other cryptocurrency investments, you need to convert all transactions into your home fiat currency (e.g. US Dollar, Australian Dollar, etc.). This requires data on all of the cryptocurrency transactions you’ve been involved with on Kraken and any other exchange you’ve used.

Staking Rewards as Income

The Internal Revenue Service (IRS) has provided guidance clarifying that staking rewards are taxable income. Cash-method taxpayers must include these rewards in their taxable income when they acquire possession of the rewards under the “dominion and control” principle. For instance, if you earn USD $600 or more in rewards from staking on Kraken, you are responsible for reporting that income on your taxes.

Capital Gains and Losses

When it comes to capital gains and losses from cryptocurrency investments, you need to determine the difference between the purchase price (also known as cost basis) and the sale price. This difference represents the capital gain or loss you must report on your taxes.

Here’s a summary of how to calculate capital gains and losses:

- Determine the cost basis of the cryptocurrency (initial purchase price plus fees)

- Calculate the proceeds from selling the cryptocurrency (sale price minus fees)

- Subtract the cost basis from the proceeds to find the capital gain or loss

Remember to keep track of your transaction details to make these calculations accurately.

In conclusion, it is necessary to have a clear understanding of staking rewards as a form of taxable income and the process of calculating capital gains and losses. Accurate records and appropriate reporting of your Kraken transactions can help ensure you stay compliant with tax regulations.

Account and Data Management

Managing your Kraken account and its data is essential for tax reporting purposes. As a user, you’ll want to have accurate records of your balance, trade history, and other transaction details.

First of all, you need to export your data to a CSV file. Kraken provides an easy way to do this directly through their platform. To export your data, follow these steps:

- Log into your Kraken account.

- Go to the “History” tab.

- Select the type of history you’d like to export, such as trade history.

- Choose a date range for the data you wish to export.

- Finally, click the “Export” button to download the CSV file containing your data.

Once you have the CSV file, you can use it for tax reporting. For example, you can import the file into a specialized cryptocurrency tax calculator to calculate your taxable gains or losses.

When it comes to account management, it’s beneficial to have a clear overview of your digital asset balances. Kraken allows you to view the total cash value of your cryptocurrency balances. This information is vital in determining the cost basis of your assets and calculating profits or losses from your trades.

In conclusion, being proactive in managing your Kraken account data is essential for tax reporting purposes. Regularly exporting your data to CSV files and keeping track of your balances will help ensure that you comply with your tax obligations and maintain accurate records of your cryptocurrency transactions.

Kraken’s API and Its Importance

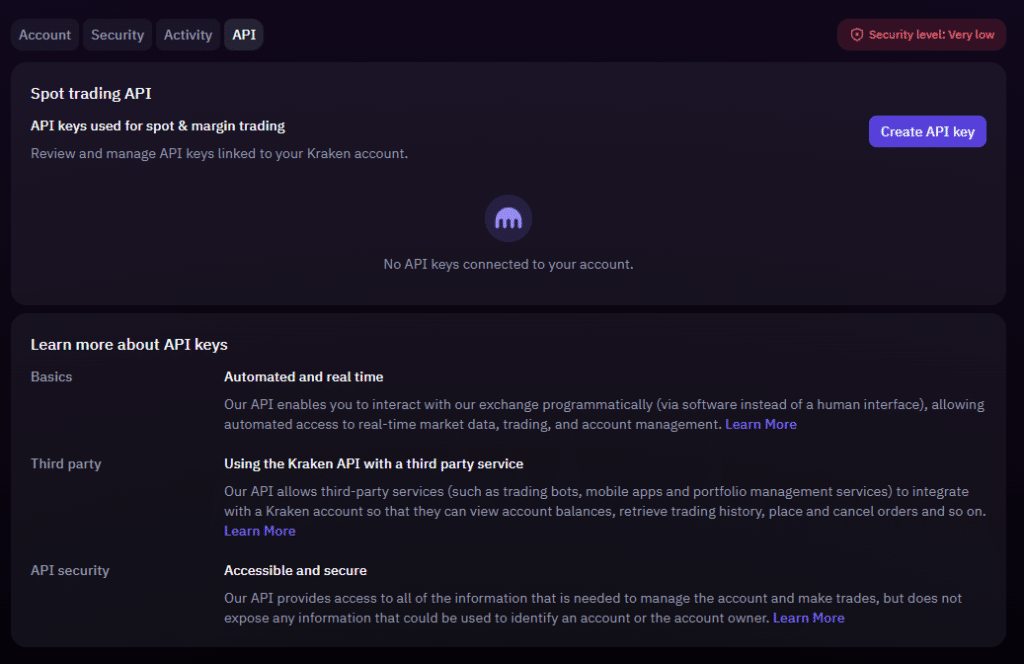

Kraken’s API (Application Programming Interface) plays a crucial role in enabling users to manage their cryptocurrency transactions and tax reporting efficiently. The API offers a secure and straightforward method for importing your Kraken trading data into various tax reporting tools, making the whole process more streamlined.

The Kraken API allows you to query ledger entries and obtain historical information about your trades, withdrawals, and deposits, which is vital for accurate tax reporting. By connecting your Kraken account to third-party tax reporting solutions like Koinly or CoinLedger, you can automate the data retrieval process, saving time and ensuring that your tax records are complete and accurate.

To use the Kraken API, you will first need to create an API key from your Kraken account settings. This key grants access to your account data and should be treated with the same level of security as your login credentials.

Here’s a brief overview of what you can achieve with Kraken’s API:

- Import trades, deposits, and withdrawals automatically to tax reporting tools

- Query account balances and other essential information

- Retrieve historical transaction data for accurate tax calculations

The Kraken API offers multiple endpoints to access various types of data, such as account balance, open orders, trade history, and ledger entries. By using these endpoints, you can create custom integrations to meet your specific needs, including tax reporting, portfolio management, or automated trading strategies.

In conclusion, Kraken’s API is an indispensable resource for simplifying tax reporting and managing your cryptocurrency transactions. By leveraging its capabilities, you can maintain accurate records and ensure compliance with tax regulations, all while saving time and effort.

Tax Reporting on the Kraken Platform

When trading on the Kraken platform, it’s essential to stay up to date with your tax reporting obligations. Kraken itself does not directly support tax reporting features, but they provide resources to help you figure out the necessary information.

You will receive tax forms from Kraken if you meet the following criteria:

- You are a Kraken client, vendor, or other business partner,

- You are a US person for tax purposes, and

- You have earned USD $600 or more from staking or the referral program, or more than USD $10 in interest or certain other income from Kraken.

Kraken issues forms like Form 1099-MISC and Form 1099-INT for individual investors, which are designed to help you report income from staking, referrals, and loan interest. The Internal Revenue Service (IRS) has requested and received customer information from Kraken in the past, so it’s crucial to stay on top of your tax reporting requirements.

To calculate profits and losses from trading and find the total cash value of your crypto holdings on a particular date, Kraken’s support and help center can provide guidance. You’ll find articles that explain how to find the cost basis of your cryptocurrency balances and trades, as well as how to calculate profits/losses from margin trading.

For more comprehensive tax reporting assistance, you can turn to third-party services like Koinly, CoinLedger, or Accointing. These platforms offer portfolio trackers that help you calculate your Kraken taxes and generate your tax report, simplifying the process.

In summary, while Kraken does not directly offer tax reporting features, it provides the necessary information and resources to help you meet your tax obligations. By utilizing the platform’s support or resorting to external tax assistance, you can confidently manage your Kraken tax reporting requirements.

Interacting with the IRS

When dealing with Kraken tax reporting, it is crucial to understand your obligations with the Internal Revenue Service (IRS). As a Kraken user, you must report your cryptocurrency trades and transactions, as they may result in capital gains tax.

To effectively interact with the IRS regarding your cryptocurrency investments, it’s essential to keep accurate records of your transactions. Kraken offers a feature where you can download and export your trading and transaction history. Use these records as a basis for preparing your tax returns.

When filing your tax returns, make sure to include all relevant information about your capital gains or losses from your Kraken transactions. This includes any profits you might have made while trading, as well as costs for purchasing and selling cryptocurrencies. Keep in mind that the IRS treats cryptocurrency as property, so you need to report any profits or losses accordingly.

Here is a simplified breakdown of the information you should gather and report for Kraken tax reporting:

- Transaction data: date, type, and specific asset involved

- Cost basis: the purchase price of the cryptocurrency, including fees

- Sale proceeds: the selling price and applicable fees

If you are unsure about specific details or need guidance on reporting your Kraken transactions to the IRS, consider seeking professional tax advice. A knowledgeable tax professional can help ensure your tax returns are accurate and you are compliant with IRS regulations.

Remember, it is ultimately your responsibility to report and pay any tax liabilities that arise from your Kraken transactions. Keeping detailed records and working with a tax professional can help you navigate the complex landscape of cryptocurrency tax reporting and avoid potential legal issues with the IRS.

Working with Tax Software

When dealing with Kraken tax reporting, it’s essential to find a reliable tax software that can simplify the process for you. Two popular options include Koinly and ZenLedger. By using these tax software platforms, you can efficiently manage and track your cryptocurrency transactions, automatically generate the required reports and save valuable time.

Koinly is a comprehensive tax software that easily integrates with Kraken. To start generating tax reports using Koinly, simply sign in and select wallets, add a new wallet for Kraken, and import your CSV file containing your full trading history. Koinly supports various tax document formats, including Form 8949 and Schedule D for US filings. It also provides comprehensive tax reports for both capital gains and ordinary income tax analysis.

ZenLedger is another recommended tax software that simplifies the process of calculating crypto taxes for Kraken users. ZenLedger can automatically import your transactions and balances from Kraken, calculate your gains or losses, and generate all the necessary tax forms. Its user-friendly interface and robust functionality make it suitable for both beginners and advanced users. ZenLedger also offers a range of helpful resources to help users better understand the complexities of cryptocurrency tax law.

When you work with tax software like Koinly or ZenLedger, you can streamline the entire process of crypto tax reporting, saving you time and effort. Take advantage of these tools to ensure accurate and compliant tax filings for your Kraken transactions. Remember to properly import your data and follow the guidelines provided by these platforms to make the most of your tax reporting experience.

Understanding Penalties for Tax Evasion

When it comes to tax reporting on Kraken, it’s essential to understand the penalties associated with tax evasion. Tax evasion refers to the deliberate and illegal act of not reporting or underreporting income, which can lead to severe consequences.

In many countries, tax evasion is considered a criminal offense, subjecting individuals to various penalties depending on the extent of the offense and applicable laws. Some common penalties include:

- Fines: These can range from a few thousand to millions of dollars, depending on the amount of tax evaded and the jurisdiction in which the evasion took place.

- Prison time: Convictions for tax evasion can lead to imprisonment. Sentences vary based on the severity of the crime and the discretion of the court.

- Interest on unpaid taxes: In addition to fines and potential prison time, individuals might also be required to pay interest on the unpaid taxes initially evaded.

- Asset forfeiture: In some cases, assets may be seized to cover the unpaid taxes and associated penalties.

To avoid these penalties, it’s crucial to accurately report and pay your taxes on any gains made through Kraken. Downloading and exporting your Kraken trading and transaction history can help you prepare your tax documents effectively. Additionally, using a tax reporting tool or consulting a tax professional can assist you in ensuring your crypto tax reporting complies with local laws and regulations.

By being diligent in your Kraken tax reporting, you can minimize the risk of tax evasion and its associated penalties. Always staying informed and maintaining accurate records is the key to navigating the complex world of crypto taxes without fear of repercussions.

Information on Digital Wallets

When using Kraken, it’s essential to understand how digital wallets work. A digital wallet is a software or hardware tool that stores the private and public keys required to interact with your cryptocurrencies. Your digital wallet is linked to one or more wallet addresses, which function as your public identity on the blockchain.

A public wallet address is a string of alphanumeric characters, which represents the destination for sending and receiving cryptocurrencies. When you make a transaction on Kraken, you’ll need to provide the corresponding wallet address to ensure that your funds are securely transferred.

Here are some key points to remember about wallet addresses:

- Your wallet address is publicly visible on the blockchain, but it does not reveal your personal identity.

- Each wallet can generate multiple wallet addresses to enhance privacy and security.

- You should always double-check the wallet address before initiating a transaction.

- Sharing your public wallet address is safe, but never disclose your private keys to anyone.

It is essential to maintain the security of your digital wallet. Follow these tips to keep your wallet safe and secure:

- Choose a reputable wallet provider and use strong passwords.

- Keep your wallet software or hardware up to date.

- Always maintain a backup of your wallet’s private keys or seed phrases.

- Enable two-factor authentication (2FA) if your wallet provider offers it.

Kraken doesn’t provide a digital wallet for long-term storage of your cryptocurrencies. They recommend transferring your holdings to a personal wallet for which you control the private keys. By doing so, you’ll have more control over your assets and reduce the risk of losing access to your funds due to exchange-related issues.

Remember, secure management of your digital wallet is crucial when interacting with cryptocurrencies. Employing best practices for wallet security ensures you’re protecting your funds on Kraken and beyond.

Insights on Kraken Transactions

When trading and investing on Kraken, it is crucial that you understand and track your transactions. This will help you stay compliant with tax regulations and allow you to analyze your trading performance more effectively. Here is some essential information about Kraken transactions, transaction history, and trades.

Kraken transactions can be classified into various categories such as trades, deposits, withdrawals, and fees. Each type of transaction has its peculiarities and impacts on your tax reporting obligations. Trade transactions involve buying and selling of cryptocurrencies, while deposit and withdrawal transactions relate to transferring funds in and out of your Kraken account.

Transaction History is a crucial aspect of Kraken tax reporting. Thankfully, Kraken provides an easy way for you to access and export your complete transaction history. This includes information about all trades, deposits, withdrawals, and other relevant details. With your transaction history, you can effectively analyze your trading activities as well as compile the necessary information required by tax authorities.

To ensure accurate tax reporting, it is essential to keep a record of your Kraken trades. Kraken trades can generate gains, losses, and income tax reports through third-party tools like CoinLedger or Koinly. These platforms allow you to connect your Kraken account via read-only API or import your transaction history data. Once you have imported your data, the tool will generate easy-to-understand tax reports based on your trading activities, assisting you in staying compliant with tax regulations.

In summary, maintaining a clear understanding and insight into your Kraken transactions, transaction history, and trades is vital to staying compliant with tax regulations and optimizing your trading performance. Don’t forget to use third-party tools like CoinLedger or Koinly to facilitate the tax reporting process and make it more efficient.

Final Thoughts and Conclusions

In today’s world of cryptocurrency investment, choosing a platform with accurate and transparent tax reporting is essential. Kraken offers various features to help you manage your crypto-related taxes.

Kraken provides US clients, vendors, or other business partners who are US persons for tax purposes and have earned specified income thresholds with relevant tax forms such as Form 1099-MISC, 1099-INT, and 1099-NEC. As it stands, Kraken may not provide 1099-B forms, but it’s essential to keep track of this as tax reporting laws are continuously evolving.

To aid with your tax reporting, consider using third-party tools and services to generate your Kraken Exchange tax report. They can sync with your transaction history and provide appropriate documentation that is necessary for your information and filings.

It is crucial, however, to ensure that these services retrieve your Kraken trades accurately and in real-time, to avoid any complications in your tax report.

When comparing Kraken with other platforms such as Gemini, it is essential to consider not only their tax reporting features but also user preferences, ease of use, and the reputation of each platform. This allows you to choose the platform that best suits your specific investment and tax requirements.

In conclusion, always stay up-to-date with any changes in the tax landscape, and maintain accurate records to make tax season efficient and stress-free.

Frequently Asked Questions

How do I report Kraken Crypto on taxes?

To report Kraken Crypto on your taxes, you will need to gather information on your trading and transaction history. Use this data to calculate your crypto gains, losses, and reportable events. Once you have all the necessary information, include it in the appropriate section of your tax return.

Does Kraken send 1099 B?

Kraken does not directly issue 1099-B tax forms. However, if you meet specific criteria (being a US person for tax purposes, earning more than $600 in rewards from staking or referral programs, or earning more than $10 in interest) you may receive a US tax form from Kraken.

Do you have to file taxes with Kraken?

Yes, if you hold, trade, or earn rewards from cryptocurrencies with Kraken, you must include the relevant information in your tax filing. Gains, losses, and income from staking or referral programs are all reportable events.

How can TurboTax be utilized for Kraken transactions?

TurboTax offers a feature for cryptocurrency users to import their transactions. You can export your transaction history from Kraken in a CSV file and import that file into TurboTax. Follow TurboTax’s instructions and guidelines for reporting your crypto trades and transactions.

Does Kraken offer any tools for tax reporting?

Kraken provides access to your account history, including trades, deposits, withdrawals, and more, which can be used for tax reporting. While Kraken itself doesn’t offer a specific tax tool, you can use third-party tax software, like Koinly, to streamline your crypto tax calculations.

What is the process of connecting Koinly with Kraken for tax purposes?

To connect Koinly with your Kraken account for tax purposes, follow these steps:

- Log in to your Koinly account and navigate to the Wallets section.

- Click on the “Add Wallet” button, and search for Kraken in the list.

- In your Kraken account, create an API key with permission to access your trade and transaction history.

- Enter the API key and secret in the Koinly form, and click on “Connect” to link your Kraken account.

- Koinly will import your transaction history and calculate your gains, losses, and other tax-related information.