Navigating the complexities of cryptocurrency trading requires an awareness of the operational parameters set forth by digital exchange platforms, notably Binance, one of the largest players in the space. While Binance offers a vast array of services to a global audience, it’s crucial to recognize that not all users can access these services due to regulatory restrictions and compliance requirements in various countries.

Understanding the restrictions placed upon Binance is essential for traders to ensure they are in compliance with their local laws and regulations. The platform’s ability to operate within certain jurisdictions is frequently influenced by a myriad of factors including local financial regulations, the legal status of cryptocurrency, and the platform’s own policies. This dynamic landscape implies that Binance’s geographic accessibility can change over time, necessitating a current and informed perspective on where the platform is restricted and where it’s fully available.

Understanding Binance and Cryptocurrency Exchange

As you navigate the world of digital currencies, two pivotal elements play a central role: Binance as a dynamic platform and the functionality of cryptocurrency exchanges within the market.

Evolution of Binance Platform

Binance, launched in 2017, began as a crypto-to-crypto exchange platform, providing a marketplace for buying and selling a vast array of digital assets. Over the years, Binance expanded its services globally, but not without facing stringent regulatory practices. For instance, it was forced to move its operations from its initial base in China to jurisdictions with more crypto-friendly laws such as Malta. It is crucial to understand the trajectory of Binance because it highlights the decentralized nature of cryptocurrency trading, and the variety of tokens it has made accessible to users.

Geographical Restriction Factors:

Geographical restrictions significantly influence who can access Binance’s services and to what extent. Regulatory frameworks differ from country to country, resulting in limitations or outright bans in specific regions such as the United States, China, and parts of Europe. In some jurisdictions, Binance operates through localized versions of its platform to comply with domestic laws, while in others, it is restricted from offering services entirely.

These restrictions often affect available features, the types of digital assets users can trade, and even the methods of deposit and withdrawal. As a result, users must remain aware of their region’s legal stance on cryptocurrency to ensure compliance and avoid potential disruptions to their trading activities.

Role of Cryptocurrency Exchanges

Cryptocurrency exchanges are the fuel to the digital asset economy, facilitating the trading of tokens and contributing to market liquidity. Your experience with platforms like Binance revolves around these exchanges where one can convert fiat currencies to crypto, trade various tokens, and engage in market speculation. The exchanges determine market prices based on supply-demand dynamics and offer trading tools, enhancing the efficiency and accessibility of the cryptocurrency market.

Key Attributes of Cryptocurrency Exchanges:

-

Liquidity and Volume:

High liquidity ensures that trades can be executed quickly with minimal price slippage. Leading exchanges like Binance often boast some of the highest trading volumes in the market, attracting both retail and institutional investors. -

Security Measures:

A reputable exchange must prioritize user security by implementing advanced measures such as two-factor authentication (2FA), cold wallet storage, encryption protocols, and regular audits. These safeguards protect users’ funds and personal data from potential breaches. -

User Interface and Experience:

The ease of navigation, intuitive dashboards, and mobile accessibility are essential for both beginners and seasoned traders. Exchanges compete by offering user-friendly platforms with responsive customer support and educational resources. -

Range of Supported Assets:

A diverse selection of cryptocurrencies and trading pairs broadens user opportunities. While some exchanges limit listings to major coins, others support a wide variety of altcoins, stablecoins, and even newer token standards like NFTs. -

Regulatory Compliance:

Exchanges must adhere to the financial laws of the jurisdictions they operate in. Compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) policies is crucial for legal operation and fostering trust among users. -

Trading Features and Tools:

Advanced exchanges provide functionalities such as margin trading, futures contracts, staking options, and real-time charting tools. These features empower traders to deploy strategic approaches and manage risk effectively. -

Fee Structures:

Transparent and competitive fee systems—whether flat or tiered—play a significant role in user retention. Lower fees often attract high-frequency traders, while loyalty programs and fee discounts (e.g., using native tokens) enhance user engagement.

Compliance, Regulation, and Restrictions

Binance’s navigation within the complex framework of international finance is marked by its adherence to and challenges with various regulatory standards. Your understanding of how these regulations shape Binance’s presence in different markets is essential.

Global Compliance and Regulation Landscape

Cryptocurrency exchanges like Binance operate globally, necessitating compliance with an array of international laws and regulatory standards. Regulation in major markets including the United States, Europe, Canada, Japan, and Australia is stringent, with entities such as the SEC (Securities and Exchange Commission) and Financial Conduct Authority (FCA) in the UK imposing strict rules for financial operations. Local laws dictate whether exchanges are licensed to operate, and in some cases, specific frameworks, like the Financial Crimes Enforcement Network (FinCEN) in the US, play a significant role.

Specifics of Binance Regulatory Challenges

Binance has faced restrictions due to non-compliance with local laws and regulations, particularly in countries like the United States, United Kingdom, Canada, Italy, France, Spain, and Germany. In response, Binance has either ceased operations in these locations or has had to modify its services to adhere to the local regulatory requirements. For instance, the FCA has impacted Binance’s operations in the UK due to concerns regarding anti-money laundering practices.

Impact of Regulations on Binance Operations

The restrictions imposed by different jurisdictions have a tangible effect on Binance’s operations. To illustrate, Binance is often compelled to modify its service offerings or withdraw them entirely in certain markets where it cannot attain compliance.

Such actions affect both Binance’s market presence and its users, who may no longer be able to access its full suite of services. In an ongoing effort to maintain operations, Binance aims to engage with regulatory bodies and adapt to the varying financial laws around the globe, indicating its dedicated pursuit of being a regulated entity where possible.

Geographic Restrictions for Binance Services

Binance, one of the largest cryptocurrency trading platforms, adheres to international regulations, resulting in service restrictions in certain countries. Here, you will find out where Binance imposes full or partial limitations on its services.

Countries with Full Restrictions

If you reside in the following countries, you are fully restricted from accessing Binance services:

-

United States – Due to strict financial regulations, Binance.com does not operate in the U.S. Instead, it offers a separate platform, Binance.US, with limited features and a reduced number of supported cryptocurrencies.

-

China – The Chinese government has banned all cryptocurrency trading platforms, including Binance, as part of its broader crackdown on digital currencies.

-

Iran – Binance prohibits services due to international sanctions and compliance with anti-money laundering (AML) laws.

-

North Korea – Due to global sanctions and embargoes, Binance does not offer any services in this region.

-

Syria – Like North Korea and Iran, international sanctions prevent Binance from operating in Syria.

-

Crimea Region – Under international law and Binance’s compliance policies, users from Crimea are fully restricted.

-

Belarus – Due to sanctions and regional compliance issues, Binance restricts access entirely.

Countries with Partial Restrictions and Limited Services

Some countries have partial restrictions or limited services where you may not have full access to all Binance offerings:

This map of restrictions highlights Binance’s commitment to complying with local financial service regulations. It is always advised to check the most recent terms of service and local laws for updates.

Financial Instruments and Trading Options

Binance offers a broad range of financial instruments and trading options catering to various investor needs. Explore the different markets and opportunities available to enhance your investment strategy.

Spot Trading and Futures

Spot trading on Binance allows you to buy and sell a wide array of cryptocurrencies at current market prices. You have access to an extensive list of crypto pairs, enabling you to diversify your portfolio effectively. Binance’s spot market is known for its liquidity and depth, ensuring that your trades can be executed swiftly.

Futures trading on Binance provides you with the possibility to speculate on the future price of cryptocurrencies. Utilizing futures, you can invest with leverage to amplify potential gains, but be aware that this also increases the risk of potential losses. Futures involve agreeing to buy or sell a particular asset at a predetermined price at a future date, and they can serve as a tool for both speculation and hedging.

Staking, Options, and Other Services

Staking on Binance means you can earn rewards by simply holding certain cryptocurrencies. This investment method locks your coins for a period, during which they help to maintain the operation of a blockchain network. In return, you receive additional coins as staking rewards, similar to earning interest in a savings account.

Options trading, another service provided by Binance, gives you the right, but not the obligation, to buy or sell a cryptocurrency at a defined price before a certain expiration date. This can be a strategic method to manage investment risks or to speculate on crypto price movements.

In addition to spot and futures trading, Binance also offers services such as savings accounts and liquidity pools, which emphasize the platform’s role as a versatile crypto trading ecosystem. Whether you’re looking to trade, invest, or leverage additional services, Binance caters to a wide variety of financial activities within the cryptocurrency domain.

Currency and Payment Methods

When engaging with Binance, it’s important for you to understand the supported fiat currencies, the variety of cryptocurrencies and tokens available, as well as the payment options you can utilize for transactions.

Fiat Currencies Supported by Binance

Binance supports a range of fiat currencies for your convenience. You can trade using major fiat currencies such as USD (United States Dollar), EUR (Euro), AUD (Australian Dollar), and TRY (Turkish Lira). Others include SAR (Saudi Riyal), RON (Romanian Leu), ARS (Argentinian Peso), ILS (Israeli New Shekel), and KES (Kenyan Shilling). This enables you to deposit and withdraw in a currency that you may be more familiar with or that is more economically viable for you.

Cryptocurrencies and Tokens Availability

Binance offers a vast selection of cryptocurrencies and tokens, providing you with the opportunity to trade popular and emerging digital assets. The platform’s cryptocurrency list is extensive, making it one of the most diverse offerings in the market. It’s essential to check with Binance directly for the most updated list of available cryptocurrencies and tokens as their availability might vary based on your location due to regulatory restrictions.

Payment Options for Users

You have a variety of payment options on Binance to manage your transactions. These include:

Payment methods might vary by country and some platforms within Binance may not support all currencies or payment options. Always verify whether your preferred payment method is available for your specific location and the associated currency.

User Experience and Trust

Your confidence in a trading platform is built on a foundation of reliable user experiences and the assurance of safety in your investments. It’s imperative to understand how Binance enforces security measures and cultivates trust among users.

Security Measures and User Safety

Your safety is paramount when trading on Binance. Stringent security protocols are in place to protect your personal information and funds. These include two-factor authentication (2FA), advanced encryption, and the use of cold storage for the majority of the platform’s cryptocurrency assets.

You are also provided with real-time security notices to keep you informed about the latest protection measures and any pertinent security events.

Building Trust with Investors and Traders

Binance is committed to fostering trust with you as an investor or trader. Clear information disclosure is a primary tool in this process. You receive complete documentation of the platform’s terms and receive immediate updates if your access might be affected by changes in your country’s regulatory framework.

This proactive communication ensures that you are never caught off-guard, bolstering your trust in the platform’s reliability.

Through consistent transparency and robust security practices, Binance seeks to deliver a safe and trust-inspiring trading experience that underscores its reputation among global users.

Alternatives to Binance

In the landscape of digital finance, you may require alternatives to Binance due to regional restrictions or personal preferences. This section will guide you through competing cryptocurrency exchanges and regional alternatives that cater to the needs of diverse traders and investors.

Competing Cryptocurrency Exchanges

Coinbase: A household name in the crypto exchange sector, offering a wide spectrum of crypto assets. It is known for its intuitive platform and has established a footprint in the United States with Coinbase Pro providing advanced trading options.

Bybit: As an emerging contender, Bybit offers a robust platform with a rich selection of cryptocurrencies. It boasts a strong reputation for security, complemented by an expansive user base.

Kraken: Renowned for its security measures and a broad range of cryptocurrencies, Kraken serves as a viable option for users seeking a Binance alternative with solid industry standing.

CEX.io: This platform is favored for its user-friendly interface and a variety of trading features, making it a strong competitor in the crypto exchange market.

Regional Alternatives and Local Exchanges

Binance US: Tailored specifically for United States users, Binance US operates within the regulatory framework of the U.S., offering a selection of services analogous to the global Binance platform.

Regional Alternatives: Depending on your location, local exchanges may offer a more specialized service aligning with regional regulations and preferences. These platforms may provide convenience in terms of local payment methods and support for local currencies.

The crypto exchange market is dynamic and regionally diverse, ensuring you have multiple options to choose from based on your geographical location and specific trading needs.

Future Outlook for Binance and the Crypto Market

As you explore the direction of Binance and the broader crypto market, consider the anticipated expansion and how innovation will potentially shape their evolution moving forward.

Projected Growth and Market Adaptation

In 2023, despite the fact that Binance faces restrictions in certain countries, the exchange is expected to continue its strategic expansion by adapting to market and regulatory demands. This might involve securing more national operating licenses and ensuring compliance with local financial regulations to access new markets. For cryptocurrencies, this period is poised to be transformative as traditional financial systems and digital assets increasingly converge.

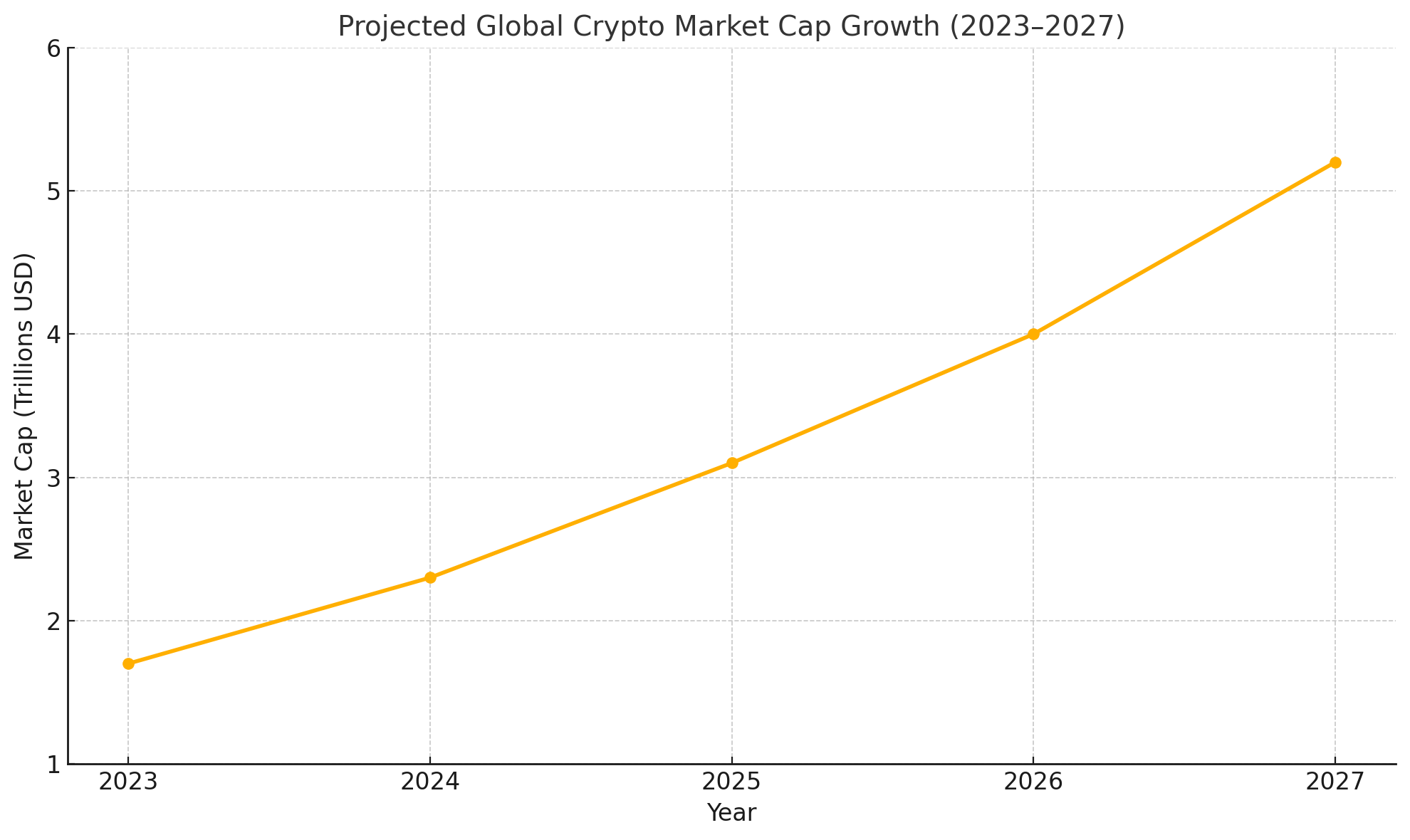

Yearly Crypto Market Cap Growth Estimation:

The global cryptocurrency market cap has shown significant volatility, yet a clear upward trend is observable over the years. In 2022, the market cap fluctuated heavily due to macroeconomic conditions and regulatory uncertainties, dipping below $1 trillion at times. However, by the end of 2023, industry analysts projected a strong recovery, estimating the market cap to exceed $1.7 trillion, driven by increasing institutional adoption, layer-2 scaling solutions, and regulatory clarity in key jurisdictions.

Looking ahead, experts forecast the following growth trajectory (based on moderate adoption scenarios and macro trends):

| Year | Estimated Market Cap | Growth Rate |

|---|---|---|

| 2023 | $1.7 Trillion | — |

| 2024 | $2.3 Trillion | +35% |

| 2025 | $3.1 Trillion | +35% |

| 2026 | $4.0 Trillion | +29% |

| 2027 | $5.2 Trillion | +30% |

Factors driving this projected growth include:

-

Regulatory frameworks becoming more transparent.

-

Major tech firms and financial institutions integrating blockchain infrastructure.

-

Increased use of stablecoins and central bank digital currencies (CBDCs).

-

Growing DeFi and NFT ecosystems regaining momentum.

Innovation in Crypto Services and Products

Binance’s dedication to innovation is set to play a pivotal role in defining its market presence. Your experience with crypto services is likely to evolve rapidly as Binance introduces new products such as decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and additional blockchain-based solutions. These innovations could lead to a more diverse and resilient cryptocurrency ecosystem, providing you with a broader range of investment opportunities.

Key Innovations Expected:

-

Decentralized Finance (DeFi) Expansion

Binance is likely to deepen its involvement in DeFi by supporting more decentralized protocols, liquidity pools, and yield farming opportunities. Through platforms like Binance Smart Chain (BSC), users can access permissionless financial services that bypass traditional intermediaries. -

NFT Ecosystem Development

Binance’s NFT marketplace is expected to grow, offering improved minting tools, cross-chain compatibility, and deeper integration with Web3 metaverses. This will empower creators, collectors, and gamers with more opportunities to monetize digital ownership. -

Tokenized Assets and Real-World Asset (RWA) Integration

Binance may begin tokenizing traditional assets like stocks, bonds, and commodities, making them tradable on-chain. This blurs the line between traditional finance and blockchain, expanding access to global markets. -

Launchpad and Project Incubation

The Binance Launchpad and Labs programs will likely onboard more promising crypto startups, offering users early access to innovative tokens and blockchain platforms while accelerating Web3 innovation. -

Enhanced Staking and Passive Income Tools

More flexible staking options, auto-compounding yields, and liquid staking derivatives could emerge, allowing users to earn rewards without locking up liquidity. -

AI-Driven Trading and Risk Management Tools

Binance may roll out intelligent trading bots, portfolio risk analyzers, and AI-powered insights to help both retail and institutional users make more informed decisions in volatile markets. -

Layer-2 and Cross-Chain Infrastructure

As gas fees and transaction bottlenecks persist on major chains, Binance could invest further in Layer-2 rollups, bridges, and interoperability tools to streamline cross-chain operations.

The intersection of market growth and innovation will ultimately dictate how you interact with Binance and the larger world of cryptocurrencies.

Frequently Asked Questions

Navigating the restrictions for Binance can be complex due to the varying regulations across different countries. Here, we answer some common queries to clarify where Binance services are available.

Which countries are ineligible to use Binance services?

Currently, countries such as the United States, Singapore, Canada, Malaysia, and specific regions in the UK face restrictions on using Binance services due to regulatory reasons.

What regions are excluded from Binance Futures trading?

Regions prohibited from participating in Binance Futures trading primarily include the United States, certain areas of the UK, and any other jurisdictions that Binance, at its discretion, has determined to be ineligible.

Are there any restrictions for using Binance in the United States?

Binance services are not directly available in the United States due to regulatory restrictions. However, U.S. residents can access limited Binance services through a separate platform known as Binance.US, which complies with local regulations.

What countries are currently able to apply for a Binance Card?

The availability of the Binance Card is selective and typically offered to residents within the European Economic Area (EEA), with plans to expand to additional regions depending on regulatory approval.

How does one determine if their country supports Binance services?

To check if your country supports Binance services, you should review the updated list of supported countries on Binance’s official website or in their terms of service, as this information may change frequently due to evolving regulations.

In which countries is Binance’s operation considered fully compliant and legal?

Jurisdictions approving Binance’s operations as fully compliant and legal are not explicitly listed in their public disclosures. To determine compliance, one must refer to local financial regulatory bodies for the current status of Binance’s legality in their respective country.

Steven has a solid Cryptocurrency background, having worked with multiple Crypto startups as CMO. He knows the ins and outs of promoting both physical products and SaaS and is now providing valuable insights when testing different Crypto services.